Performance-based incentive system: Benefits and challenges

Performance-based incentive systems boost productivity and retention, but also bring challenges like financial risks. Assess readiness with a free scorecard.

Your employees have been throwing around the term ‘performance-based pay’ for a while now, and it feels like your competitors are really into it as well. However, you’re not sure how this should work, or if it would even work in your business. It’s uncharted territory, and it could cause more problems than it solves.

Your concerns are warranted. That’s why we at BuddiesHR have taken a deep dive into this topic - you don’t have to. Here’s the short version of this topic. 👇

Key Takeaways

- Performance-based incentives boost retention and align employees with business goals.

- Transparent, consistent design reduces risks like unfairness or financial strain.

Table of Contents

- What is a performance-based incentive system?

- How are pay-for-performance incentives calculated?

- Types of performance incentives

- Benefits of a performance incentive scheme

- Challenges of a performance incentive scheme

- Balancing benefits and challenges

What is a performance-based incentive system?

Performance-based compensation is a way of rewarding workers for their direct contribution to the success of the business. Instead of offering salary ranges for different jobs, employers offer incentives based on performance metrics. These incentives work because they recognize top performers and cultivate a spirit of excellence.

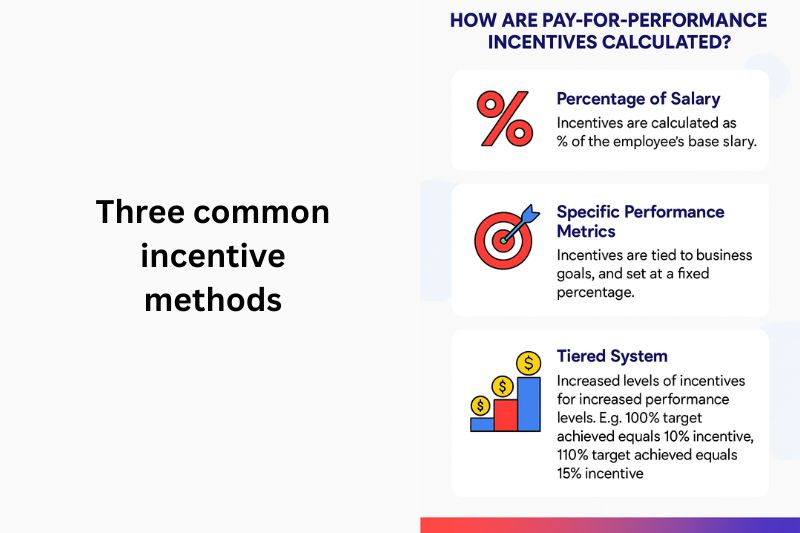

How are pay-for-performance incentives calculated?

There are three commonly used incentive methods that are linked to employee performance:

- Percentage of salary: Incentives are calculated as % of the employee’s base salary.

- Specific performance metrics: Incentives are tied to business goals and set at a fixed percentage.

- Tiered system: Increased levels of incentives for increased performance levels. For example, achieving a 100% target equals a 10% incentive, while achieving a 110% target equals a 15% incentive.

Each of these models has its strengths, and which one you choose will depend on the goals you have for the incentive system. For example, if you’re continually reaching for higher targets, a tiered system will be best.

While choosing the right calculation method is important, the success of any model also depends on how employees perceive it. Find out what your employees think by running an employee survey or poll with Pulsy Survey.

Types of performance incentives

Incentives can be adapted to suit any industry, culture, size, or remuneration structure. Here, we look at the most common incentives used by companies.

- Individual incentives: An employee is given set targets, and the incentive is directly linked to personal achievement. Stretch targets are given to boost performance to a higher level than previously attained.

- Team incentives: Teams are encouraged to collaborate to meet set targets, project deadlines, quality benchmarks, or customer satisfaction goals.

- Profit sharing: A percentage of the company’s profits is shared amongst workers who meet certain performance expectations.

- Merit-based pay raises: Annual increases are given based on performance reviews rather than tenure.

- Recognition rewards: Incentive programs are implemented that reward employees with non-cash rewards such as health and wellness perks.

Example of a team-based performance reward: At a mid-sized tech company, they’re about to launch a new product. The management team agreed to implement performance-based rewards for these projects. They motivate employees by giving them a 10% incentive bonus if they meet their projected sales targets on the new product for the quarter. Performance is monitored using a performance review system, Simpleperf.

Benefits of a performance incentive scheme

This section gets to the heart of the matter - why should any business decide to participate in pay-for-performance financial incentives? The benefits must outweigh the downsides, and the cost of the scheme will not withstand scrutiny.

1. Boost productivity and high performance

In Wonderland, everyone comes to work bright-eyed and bushy-tailed, ready to take over the world, but not so in the real world. You have to keep employees motivated, and one way to do that is to link monetary incentives to their individual performance. The ability to make more money than a job role normally allows is intoxicating and highly motivating.

But do employees like this kind of pay model? One research paper suggests that financial rewards can be expected to enhance job satisfaction because they signal to employees that they are competent and that their contribution is valued.

But there is one caution - you must ensure performance goals are achievable - otherwise it will have the opposite effect on employee morale. [1]

2. Retention of top talent

Top performers are drawn to a combination of compensation-based incentives, such as bonuses, profit-sharing, and stock options, as well as growth-focused incentives like professional development programs. If you’re serious about attracting the top industry talent, you need to tailor your compensation plan to include a variety of performance incentives.

You know what else top talent likes? Regular performance reviews where their work can be showcased and discussed. This is where performance review software supports your incentive program - you customize it according to your needs, and not only will it help you drive performance, but you’ll have concrete evidence of how your top talent is doing.

Let’s put this in perspective. A Gallup poll reported that 51% of respondents are actively seeking a new job. Let’s say you have 30 employees, and by year's end, half have resigned. Each replacement costs 33% of a worker's salary. [2] Let’s set this amount at $25K per worker. That’s a whopping $625,000 rehiring cost. Rather, keep the employees you have!

3. Alignment with business goals

Aligning the incentive program to business goals creates a perfect system for everyone to benefit. If you don’t align incentives to business goals, then you’ve just created monetary rewards that have no end goal and drain your budget. Financial growth for your company is a huge advantage of driving performance with incentive schemes, and if it doesn’t achieve that, it’s not worth it.

4. Build a thriving workplace with good company values

Everyone is always talking about building a great company culture and what that could mean. If you’ve ever tried to improve or change culture, you’ll know that it’s not the easiest thing to do, so if you can link rewards to the culture values you want to see expressed, you’ve hit the jackpot. Incentivize the behaviors you want to see, and you will surely see them.

Further reading: High Attrition Rates: Is Company Culture the Root Cause?

Challenges of a performance incentive scheme

Yes, there are challenges to implementing a performance incentive scheme, and they can be hard to deal with if not handled correctly. However, if you can balance healthy competition with how employees perceive your overall compensation philosophy, you’ll minimize the impact of the challenges.

1. Unhealthy competition

Can unhealthy competition become hard to manage? Sure. Especially in professions that push hard on short-term focus, such as sales teams. If you feel that pay for performance will have a negative impact, then you could focus on team incentives and create appreciation for teamwork, cooperation, and open communication. Tangible rewards earned together leave a great positive impression.

2. Financial overload on the business

This can become a reality when performance incentives are not properly worked out (i.e. a lot of number crunching by the finance team), or the incentives are not driving business growth. Any recognition programs must have the organization’s success as the first priority, and then the remuneration goals of the workers. That’s not selfish - that’s just good business sense.

3. Equity and fairness issues

Any perception by employees that the incentive system is applied unfairly will erode the positive benefits of the compensation model. To counter this, it is essential to make the assessment criteria as transparent as possible. Tell your employees how the incentives will be earned, when they will be assessed, who will do the assessment, and when they will be paid.

If you want to step up transparency a notch, share who received incentives and what performance criteria they met to receive their rewards.

Balancing benefits and challenges

No performance-based incentive system will be perfect - but with the right approach, you can highlight the benefits and mitigate the risks. Focus on these best practices:

- Always be transparent: Document and clearly explain how incentives are earned.

- Keep goals realistic: Stretch your employees without causing burnout and dissatisfaction.

- Balance monetary and non-monetary rewards: A good mixture of both serves to incentivize as many workers as possible.

- Measure broadly: Avoid a narrow focus on one metric such as revenue.

- Review regularly: Update the incentive program as business needs change, and share the changes with all employees.

Conclusion

Top talent increasingly seeks out companies with performance-based incentive systems—and that’s good news for employers.

By carefully considering the benefits you can get, such as business growth, a boost in productivity, retaining top talent, and creating a culture that thrives on excellence, you’ll come to see that the pay-for-performance incentive model can work. However, caution is advised about how you implement the system so that it doesn’t cause unhealthy competition, a financial overload on the business, or fairness issues.

Get started here 👉Use our FREE scorecard to rate your performance-based incentive system.

Frequently Asked Questions

1. Are non-monetary incentives as effective as cash ones?

Yes, they can be. Many employees value recognition, paid time off, work hour flexibility, and growth opportunities as much as cash. For a well-balanced incentive scheme, use a healthy mix of both.

2. What industries benefit most from incentive systems?

Sales, tech, professional services, and customer service often see strong results. However, incentive systems can be adapted to suit almost any industry or company size.

3. How long does it take to implement an incentive system?

Anywhere from 4-12 weeks is a realistic timeframe for most companies.

4. Can small and medium-sized businesses implement a performance-based incentive program?

Absolutely. SMBs can successfully implement performance-based incentives as long as financial constraints are considered, and goals are clearly defined and communicated.

References: